While the popular narrative of intractable intergenerational conflict between baby boomers and millennials (and, to a lesser extent, Gen Z) makes for juicy social media fodder and profitable internet clickbait, the constant bickering only obscures the reality that both generations are being fucked over by the same system. It is true, as millennials often point out, that many older Americans enjoyed economic opportunity and prosperity that are largely unknown in the present day. Equally true, as boomer apologists often highlight, is that simply working was, once upon a time, a reliable way to provide a comfortable and secure lifestyle for oneself and one’s family. What the latter fail to appreciate, however, is that the middle-class lifestyle of the mid-20th century has become exponentially more expensive and that opportunities to “get ahead” are becoming more elusive. The differences in experience and perspective between the generations cannot be ignored, but there are also many examples of their respective hardships and anxieties overlapping, demonstrating how the country’s toxic economic ideology has created an untenable situation for boomer and millennial alike.

A tired trope in this intergenerational sitzkrieg is that millennials are timorous snowflakes that do nothing but blame others for the ever-increasing cost of living, years of lackluster wage growth, the steady erosion of social welfare programs, the insipid drudgery of the modern workplace and the fading prospects of a meaningful retirement. Millennials are frequently told they need to “grow up” and “get over” themselves. They are ridiculed for their supposed lack of entrepreneurial spirit and chastised for their socialist delusions of living wages and a supportive regulatory environment. However, for all their posturing and crowing, boomers are not immune to the effects of rapacious Wall Street firms, nor are they prepared to handle the grim reality of retirement in an end-stage capitalist world. After all, boomers must eat (average 2.6% price increases every year since 2010)1; they have to put gas in their vehicles (about 68% more expensive than in 2010)2; they have housing expenses (current median home prices are about 7.5 times annual household income)3 as well as medical bills and none of these expenses are in decline.

Furthermore, these expenses do not vanish just because one stops punching a clock. Yet, in spite of sanctimonious Facebook posts and smug memes suggesting otherwise, boomers have apparently done a less than stellar job of saving for retirement and are at risk of significant financial struggles once their paychecks cease. Just a little over half of Americans in the baby boomer generation have any formal retirement account (incidentally, this is only about 10 percentage higher than millennials)4. These self-proclaimed paragons of fiscal virtue and tireless champions of capitalism are, when retirement finally does arrive, likely to discover that a lifetime of “hustling” and “bootstrapping”, foregoing time off and eschewing work-life balance won’t afford them the standard of living or financial security they had envisioned. One million dollars has become a bare minimum recommended savings for people hoping to avoid dying of old age on the clock and the vast majority of Americans, whatever their generational allegiance, are nowhere near amassing such a sum.

Unless fortunate enough to work for a company or public sector entity that offered prescribed retirement benefits (e.g. a pension), most boomers and an even greater number of millennials’ post rat-race hopes and dreams hinge upon the whims of Wall Street executives and Washington insiders. The standard for many years has been for employers to offer various savings plans that minimize expense and risk for the sponsor and shift that risk onto employees. Even though most employers provide some kind of funds matching and the potential for major gains is greater with an investment-based scheme than with a traditional pension, the potential for significant or even catastrophic losses is also greater. The era of defined retirement benefits as an incentive to attract and retain employees has been all but replaced by a hodgepodge of alphanumeric abstractions like 401(k), 403(b) and IRA, each with a laundry list of restrictions and rules that make it almost impossible to navigate without help from a profit seeking advisor.

This move from classic pensions and reliable Social Security payments to an inscrutable collection of commercialized investment vehicles marketed by companies unburdened by fiduciary responsibilities has exposed millions of American workers to volatility they are ill-prepared to weather and risk they are unprepared to shoulder. Consider the 2008 financial implosion we now call the Great Recession. It has been estimated that hard working Americans lost some $2.4 trillions (yes, trillion) in retirement savings within the first few months, all due to circumstances far beyond their control.5 It ridiculous to pretend that any amount of prospectus research, asset diversification or trend monitoring would have helped average 401(k) account holders avoid such a sudden and colossal evaporation of wealth; the Great Recession was the product of systemic failures on the part of corrupt and disinterested regulators combined with shadowy financial machinations on the part of Wall Street mainstays. Only the most fanatical students of high finance and the individuals manipulating the purse strings would have had any chance at mitigating their losses.

This is what is lost in the cacophony of TikTok diatribes and Reddit meme wars: the System is an equal opportunity oppressor. Wall Street kingmakers and the Silicon Valley nouveaux riche care nothing for the millions of lives that might be derailed as a result of their profligacy – that’s how so many millennials have been priced out of homeownership. Lawmakers, often with close ties to the very industries they ostensibly have oversight, are quick to shovel billions of dollars onto corporate bonfires (e.g. AIG and domestic automotive manufacturers) at the expense of social welfare programs and even the foundations of modern civilization (e.g. public health and education). Boomers hesitate to acknowledge this reality because it is a system of their own creation, born out of a lust for consumption, nursed by a mad rush of deregulation and raised by career politicians enshrining in law bankers’ and industrialists’ agendas. The reality will, however, be harder to ignore once the wave of boomer retirees in earnest crashes onto the beaches made barren by Social Security mismanagement, gutting of Medicare and chronic inflationary pressure making their scant savings stretch even thinner. Factor in their children being unable to offer support, the exorbitant cost of long-term care, the unpredictable expense of everyday life and the very real possibility of having to work into their 70s and 80s just to pay for homes they can no longer afford, and the near future does not look too bright for the majority of boomers.

But the boomers are not alone. Despite the image of being hopeless slackers and spoiled brats too wrapped up in video games and pronouns to bother facing the “real world”, millennials are looking to the future. They are trying to make things work out, but they are also trying to envision themselves and their descendants in a new and better world. Millennials have a right, even a responsibility, to be upset at the hand they have been dealt. They hold expensive college degrees that become less and less valuable every year. Their livelihoods and their futures are under constant threat by reactionary and radical policies made by people with whom they share neither ideological or social commonalities. They have the unenviable distinction of being considered the first generation in American history to have a lower standard of living than their parents.6 Their lives have been framed by national tragedy (9/11), two decades of death and misery under the guise of a “war on terror”, an epic financial crisis followed by a recovery that never really included them and, most recently, a global pandemic that completely and irrevocably altered the very concepts of work. Even those who have managed to find (and hold) a well-paying and personally fulfilling job have found it difficult to cover even the basic costs of hearth and home; putting money aside for emergencies or big-ticket purchases is almost inconceivable. They have seen their paychecks remain unchanged even as rent, fuel, utilities, childcare and insurance premiums have steadily increased.

If we filter out the misguided animosity directed towards the younger generations, we hear boomers complaining about the same things. While they are often put off by the social changes broadly described as “wokeness”, they also long for a time when a day’s work was well rewarded and a family could live reasonably well from a single income. Millennials have never experienced that, but they want to see that too. Boomers express outrage at having hundreds of dollars withheld from their paychecks for programs or services they don’t like — millennials would love to keep their earnings too. Millennials are upset and boomers should be upset as so many of the issue the former call out are issues that will make the latter’s retirement much harder.

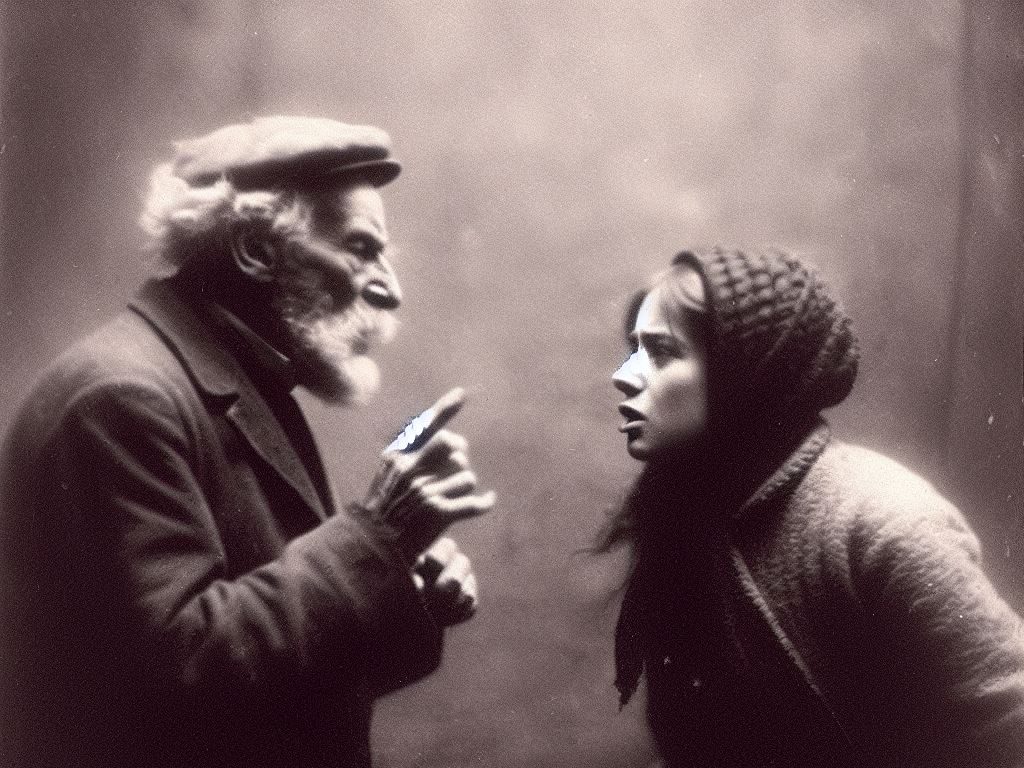

We know that social media is a poor barometer of actual human interaction. Content is often sensationalized, taken out of context or deliberately presented to appeal to the algorithms or to latch on to the trendy topic of the moment. Platforms tend to sift users into camps and then capitalize on that segregation by baiting the camps into fighting meaningless battles, generating traffic and ad revenue in the process. It is no secret that this results in reinforced prejudices and does nothing to further discourse and productive debate on the actual problems. What is needed is an intergenerational armistice, a ceasefire that allows both groups to realize their true enemies are not each other but rather the financial gamemasters that tune The Economy to their chosen frequencies and the political toadies that enable them. The great promise of the early internet, the bringing together of people and ideas to achieve a kind of unified borderless community, was long ago hijacked by corporate interests looking to exploit the masses in the online realm as well as the corporeal. We must fight the urge to play that game by volleying half-truths and shallow accusations across the virtual battlefields of TikTok and Twitter (or X as Elon Musk rebranded it) and instead use these powerful communication platforms to seek out allies and comrades in addition to likes and followers.